Contextualising Problematic Merchants

Creating dedicated help pages for PayPal transactions to ease customer frustrations

Customers contact the bank for many reasons, incurring telephony fees and utilising call centre resources. In many cases, there is a digital solution to customers' queries within the app however they usually have trouble finding it. As part of the bank's shift toward a digital-first approach, my team plays a crucial role in reducing call demand by empowering customers to self-serve and address issues independently through the app. Our focus revolves around furnishing contextual information related to transactions and merchants.

Through continuous research, it became evident that PayPal is a problematic merchant causing issues for many customers. Since it can be used for a variety of payment types, the challenges associated with PayPal are intricate and extend widely.

Stats

At the start of 2023 we found that PayPal related customer service queries made up...

of disputed debit transactions

of cancelled pending transactions

of debit card fraud

in total, this drives around

calls per month

Our task was to bring this number down by giving customers more context about their transactions and pre-empting problems. This would help customers reach a resolution quicker and reduce the business' call-centre costs.

Research round 1

Led by our in-house researcher, our team interviewed 8 customers who recently contacted the bank regarding PayPal. We found that, the PayPal issues customers mostly call about involve online purchases of goods from private sellers and the goods not arriving or being counterfeit. Customers then call to request a refund from the bank.

Customers are also not initially aware about the different PayPal methods like Friends & Family (FF) and Goods & Services (GS). They most likely only learn about GS buyers' protection once they have been a victim of a scam.

Below are some insights based on quotes from our research:

Customers prefer to use PayPal when making online purchases

"I think it's safer than using your debit card. You've got the protection if something goes wrong, you can get the money back and whatever, but with a debit card, you can't. Once it's gone, it's gone" – (P1)

Customers trust their bank more than PayPal's customer service

"They take so long to actually get back to your queries ... the people that are on the other side that you're speaking to are rude" – (P4)

Customers prefer speaking to a real person rather than a bot

"No, I think with something like that, because you have to explain it all, it's easier to call the bank ... on chat bots and things ... you don't get the answers you want" – (P1)

Customers are initially uninformed about purchase protection that comes with Goods & Services (GS) vs Friends & Family (FF)

"I think it was probably from being burnt a few years ago from buying something that was put down as a friend and family, and I didn't get it" – (P3)

Customers contact the bank numerous times to follow up on their current dispute case

"I mean, it just takes a long time. It takes a while for them to look into a case. So you know you're not going to get your money back instantly" – (P3)

Ideation

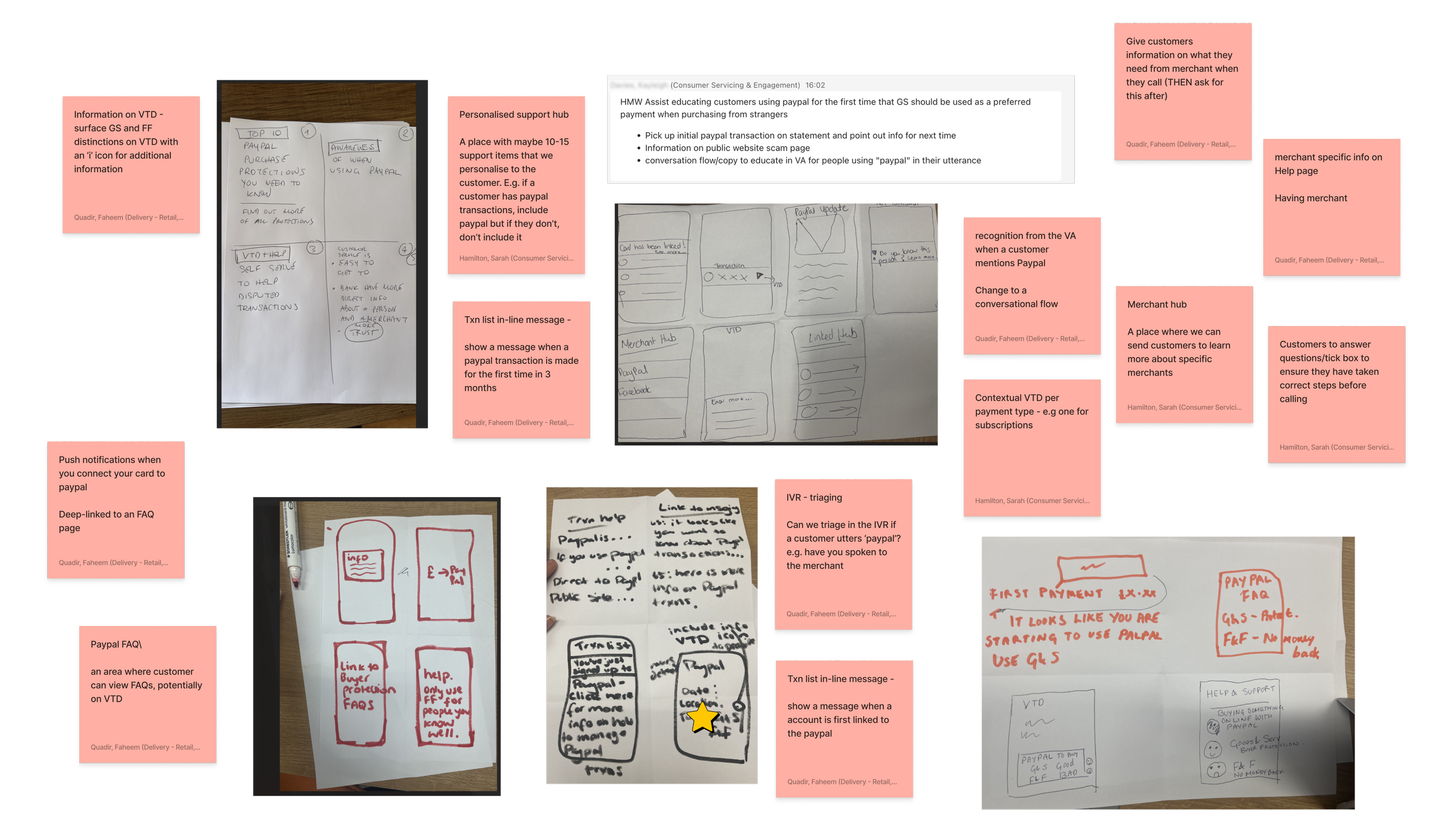

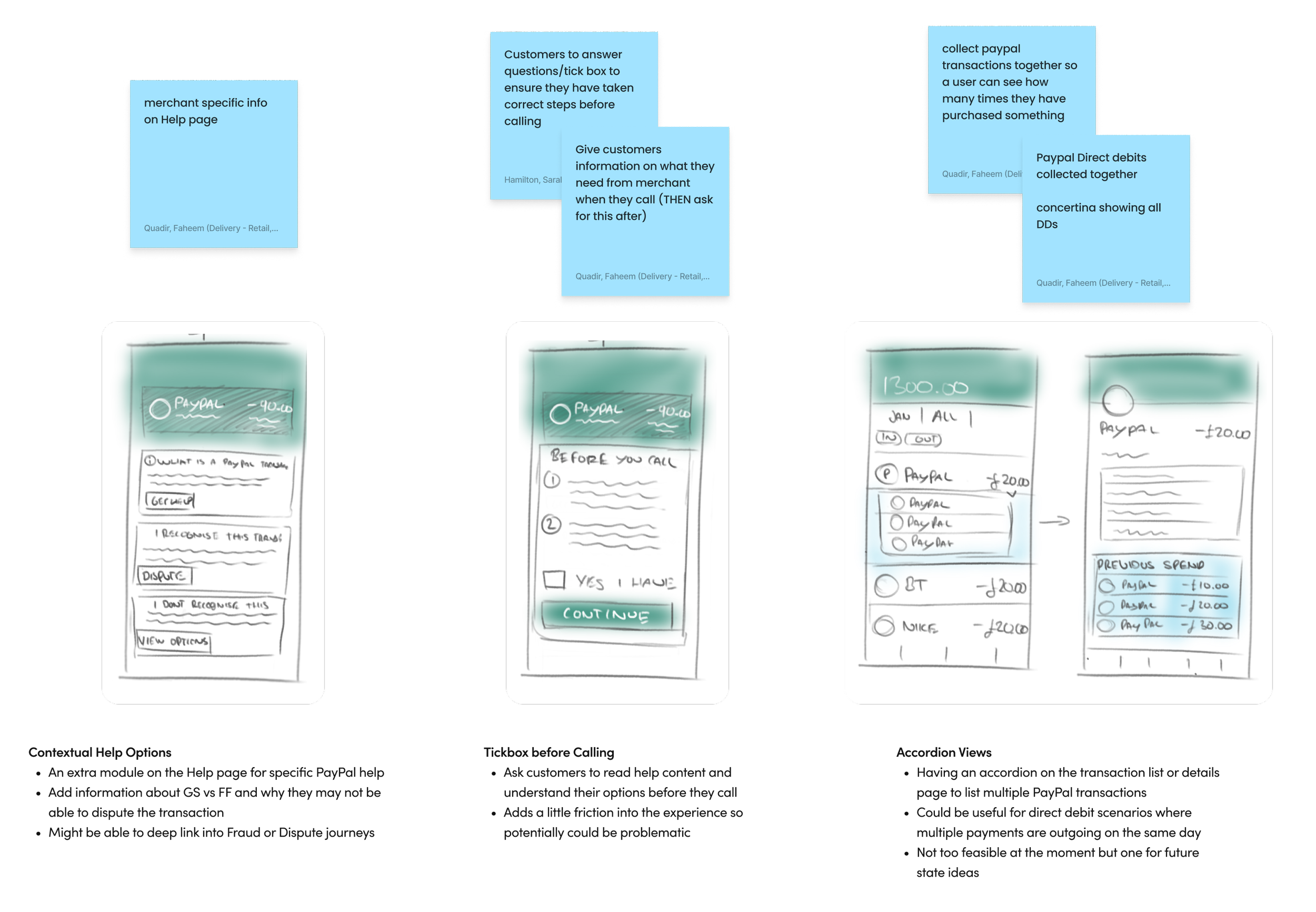

I hosted an ideation session where we generated some 'How might we' (HMW) statements based upon the previous research. I then asked our team consisting of Product Owners, Researchers, Content Designers and UX Analysts to come up with as many ideas as they could. The ideas didn't have to be realistic, they just had to be ideas. Three sticky notes per person per HMW. The corresponding HMWs are below:

HMW educate customers using PayPal for the first time that G&S should be used as a preferred payment type when purchasing from strangers?

HMW provide customers with the correct information before they call the bank?

Prioritisation

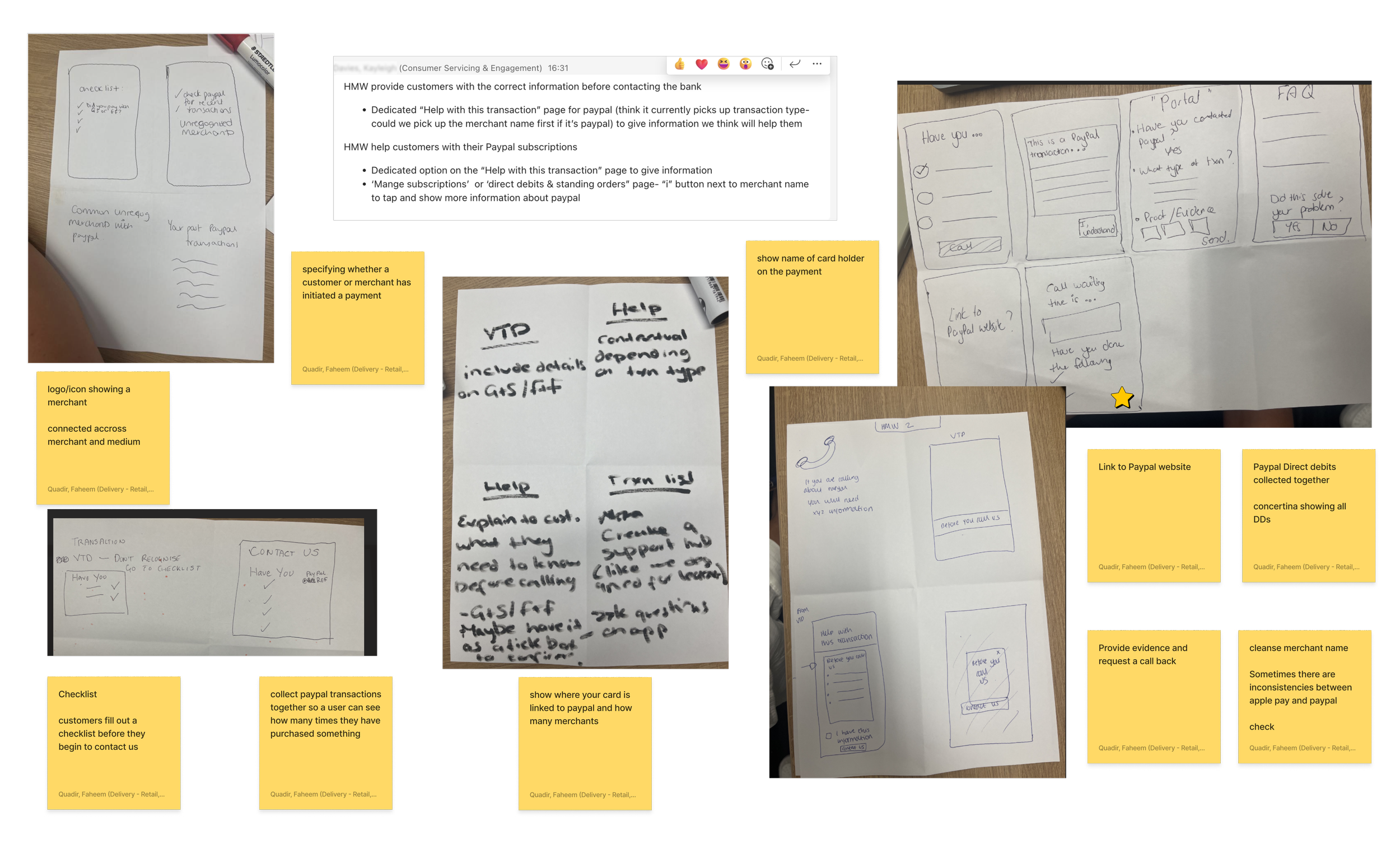

The next step was to take our ideas and prioritise them between customer and business value. We used a prioritisation matrix to decide on which features would be most feasible and desirable. This was a useful activity to take with both creative and technical members of the team.

Concept Generation

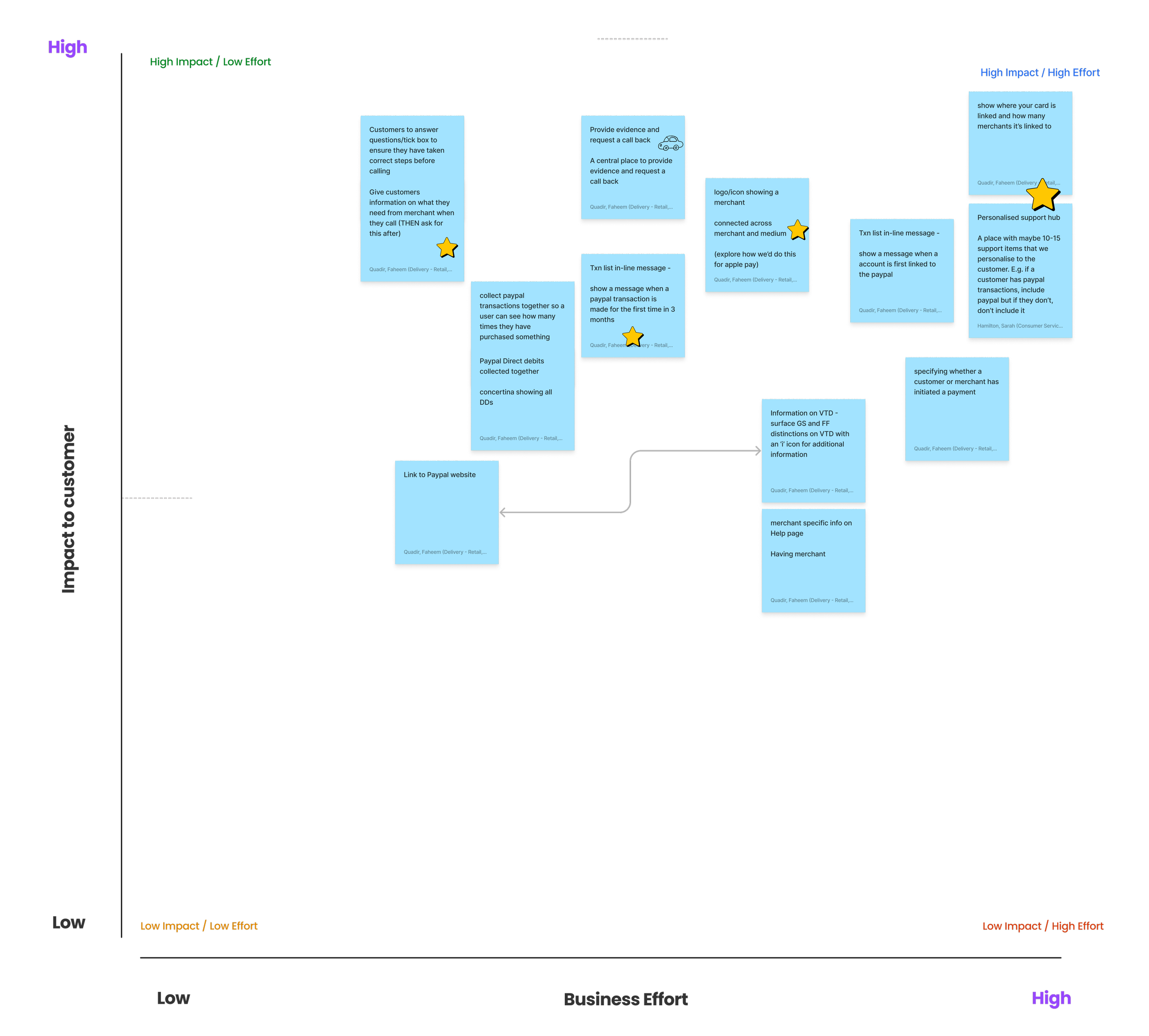

Now that we had some cues to design from, I took these notes away and began generating some basic concepts that could fit into our various pages.

Research Round 2: Unmoderated Testing

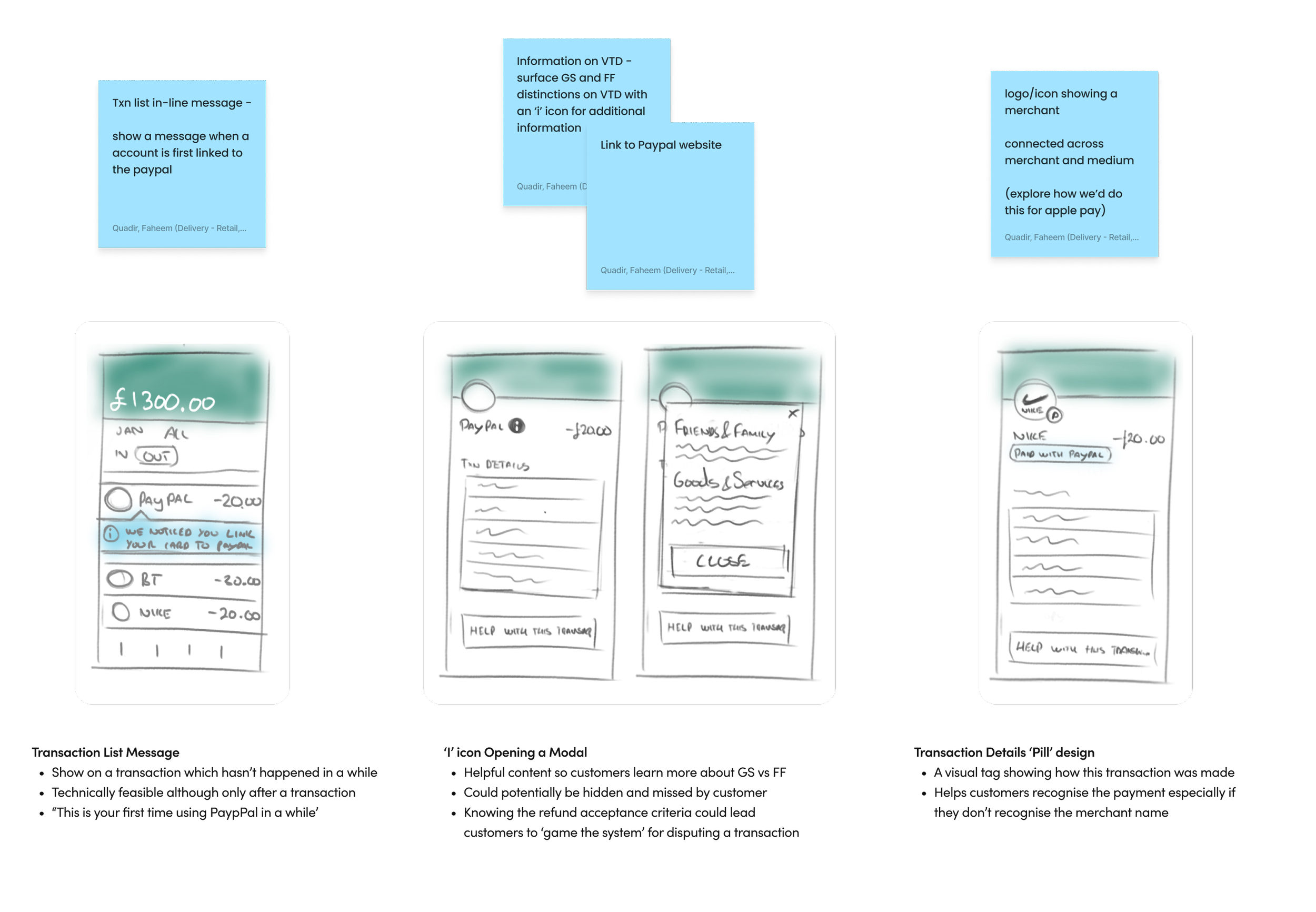

After creating these basic design artifacts and ideas, we launched our second research session. Our researcher created 3 unmoderated testing sessions where participants were presented with our concepts and asked to complete tasks and respond to prompts.

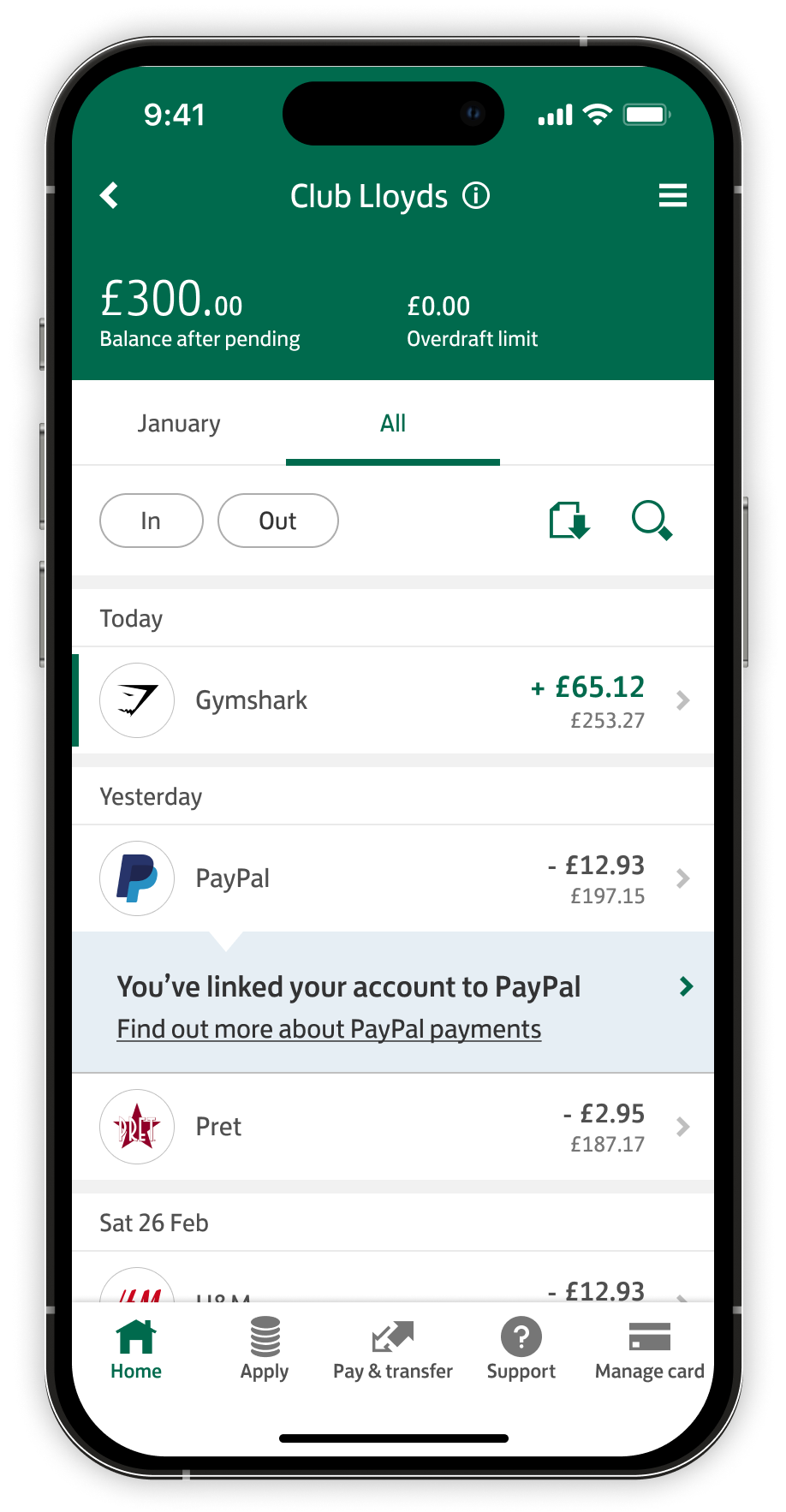

Task 1: Initial Impressions

Prompt

"You have signed into your Club Lloyds account and see the payment you have made via PayPal.

Pay particular attention to the PayPal transaction and state your initial impression and understanding of what you see. Show what you would do if you saw this notification and explain why."

Findings

- 75% of users clicked on the link in the notification.

- Only 2 users closed the notification.

- All users went into the VTD to explore the transaction further

Quotes

- "I might not take any action, if I'm familiar with that particular payment." (P4)

- "If it wasn't suspicious, I wouldn't delve into it too much." (P3)

- "Provided it was a genuine transaction, I'd do nothing at all because I'd be expecting it." (P10)

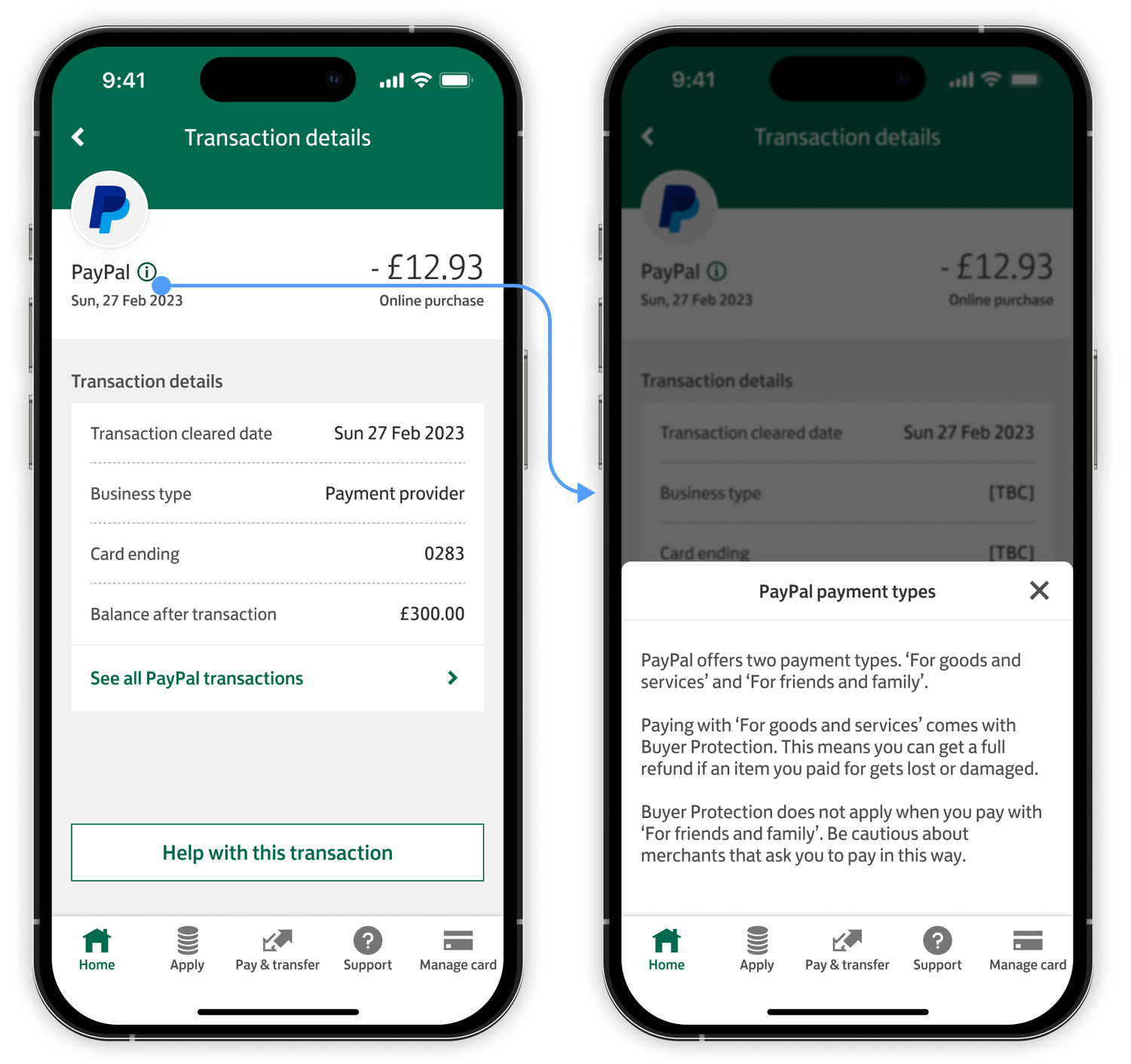

Task 2: Details page and PayPal Info Icon

Prompt

"In this scenario, imagine the notification is no longer visible on your transaction. You want to find more information regarding PayPal payments.

Please show how you would go about finding that information and provide feedback on any observations you make along the way."

Findings

- A third of users saw and clicked on the information icon and found the information clear. However, most users just scanned through the info.

- 4 Users went straight to 'Help with this transaction' instead of the icon and were pleased with the amount of information available to them there

- 2 Users who had read the info on 'Payment types', started looking for the payment type in the VTD. Both queried whether 'Business type' was indicating 'Payment type'.

Quotes

- "There is actually more information available to me than I thought"

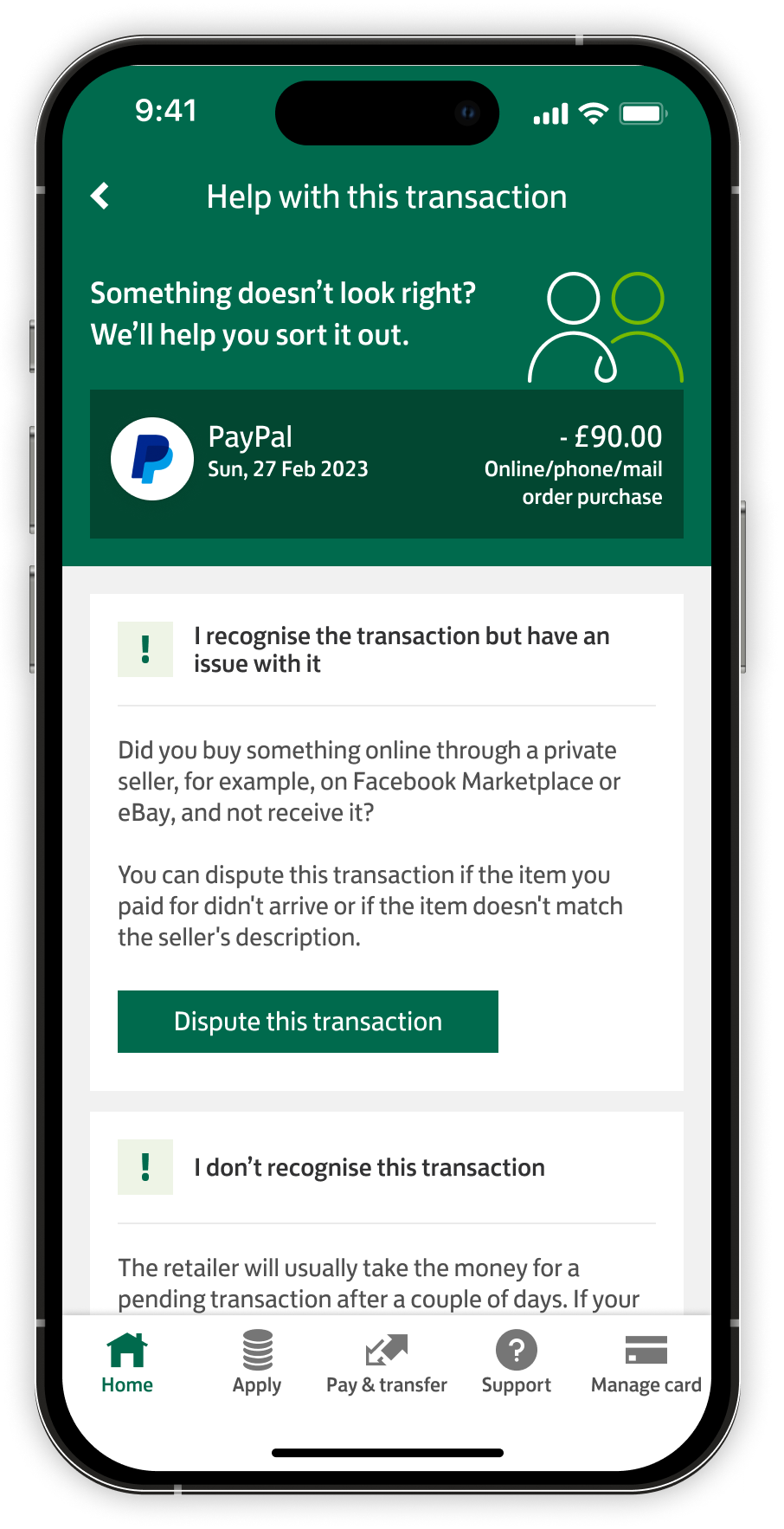

Task 3: Help and Dispute

Prompt

"Imagine you bought a pair of shoes on Facebook Marketplace using your PayPal account. You have not received the goods as promised and would like to request for your money back. Please show how you would go about doing it in the app."

Findings

- All users successfully discovered the dispute journey.

- 2 Users failed to read the check-list and just clicked complete anyway.

- 1 User felt trapped, as he didn't know what to do if he had not completed the check list.

- 2 Users commented on next steps, saying they would expect the bank to contact them after completing the checks or be able to track progress.

Quotes

- "I would expect some kind of confirmation or next steps after this"

- "The checklist is helpful but I'm not sure what happens if I can't complete all items"

Key Insights and Next Steps

Based on our research and testing, we identified several key opportunities to improve the PayPal transaction experience for customers. The testing validated our approach of providing contextual information and self-service options directly within the banking app.

Education is Key

Customers need better education about PayPal payment types (Friends & Family vs Goods & Services) to make informed decisions and avoid disputes.

Proactive Information

Providing contextual information at the transaction level helps customers understand their options before they need to call customer service.

Clear Dispute Process

The dispute journey needs to be more transparent with clear next steps and progress tracking to build customer confidence.

Reduced Call Volume

By implementing these solutions, we expect to significantly reduce PayPal-related customer service calls and improve overall customer satisfaction.