Direct Debit Indemnity

Creating a digital pathway to help customers cancel historic direct debits and claim indemnity refunds

When a customer cancels a Direct Debit within the Direct Debit & Standing Order Payments hub, it often results in the Direct Debit being reinstated by the merchant. Subsequently, customers frequently contact customer service to register complaints and request a refund for the Direct Debit. The current process involves a call centre colleague completing a DD Indemnity form on the customer's behalf. This procedure is time-consuming, with the customer answering only a few questions and being placed on hold while the colleague fills out the form.

Background

Direct Debits paid by customers in 2022 with a total value of ~£30 billion

Direct debits are cancelled annually

Indemnity claims in 2022, half of which were Same Day Recalls

Calls per month relating to direct debits

Business context

- •Existing app functionality allows customers to cancel upcoming direct debits. However, we needed to design a digital pathway for claiming indemnity refunds for historic direct debits.

- •Customers usually contacted customer service for assistance in such cases.

- •The project was a collaborative effort involving three teams: Payments, Chatbot, and Digital Transactions.

- •The MVP launch focused on enabling Same Day Recalls, allowing customers to claim refunds for payments that left their account but not yet cleared the bank.

- •The next phase involves launching full direct debit indemnity, giving customers the ability to claim refunds for any direct debit transaction, provided it meets the acceptance criteria.

How do direct debits work?

- •Direct debits, facilitated by BACS (Bankers' Automated Clearing Services), automate recurring payments between customers and merchants.

- •BACS payments have a process time of 3 days.

- •Customers can try to cancel the DD but can't as it has already been taken from their account.

- •However they are eligible for a 'Same Day Recall' indemnity since the money has left their account but not the bank itself until 3 days later.

The Customer Journey: Before

DD indemnity claims annually came from slightly active customers

The average hold time for a customer

Of DD claims were rejected

Customer notices the company has taken a few more payments after they cancelled an upcoming DD in the app.

Customer calls LBG customer services.

A LBG colleague completes a ServiceNow form where almost 85% are eligible for a straight through refund.

Fund returned to customer in 30 seconds of claim being submitted.

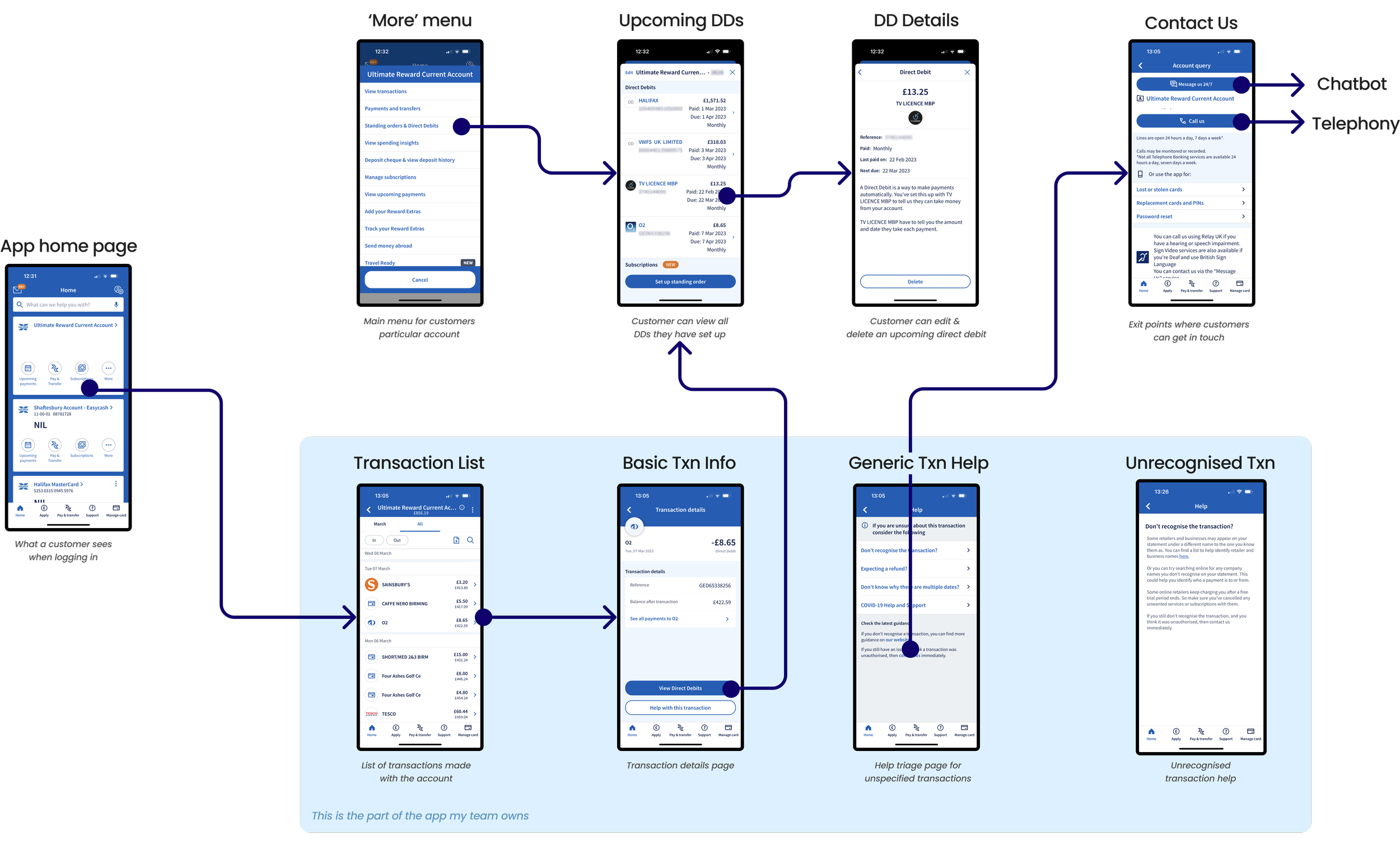

Previous App Sitemap

This sitemap depicts the entire Direct Debit (DD) experience on Halifax before our team implemented design changes. The old details page lacked comprehensive information about Direct Debits, treating them as regular transactions.

Our section of the app (highlighted in blue) included links to areas owned by the Payments team, and it was essential to preserve these links during the redesign. My responsibility involved enhancing information within our section of the experience and creating pivotal entry points to the chatbot, strategically diverting traffic from telephony.

Technical Constraints

After discussions with the Payments team in stakeholder meetings, we identified technical limitations in the Direct Debit scenarios. Due to constraints in the API, proving that communication backward with our page was not feasible, as communication backward with our page was restricted. To address this, we simplified the information on our help page and included detailed generic content. Additionally, to minimize customer queries, we also pursued FAQ content as a proactive measure.

Page Designs

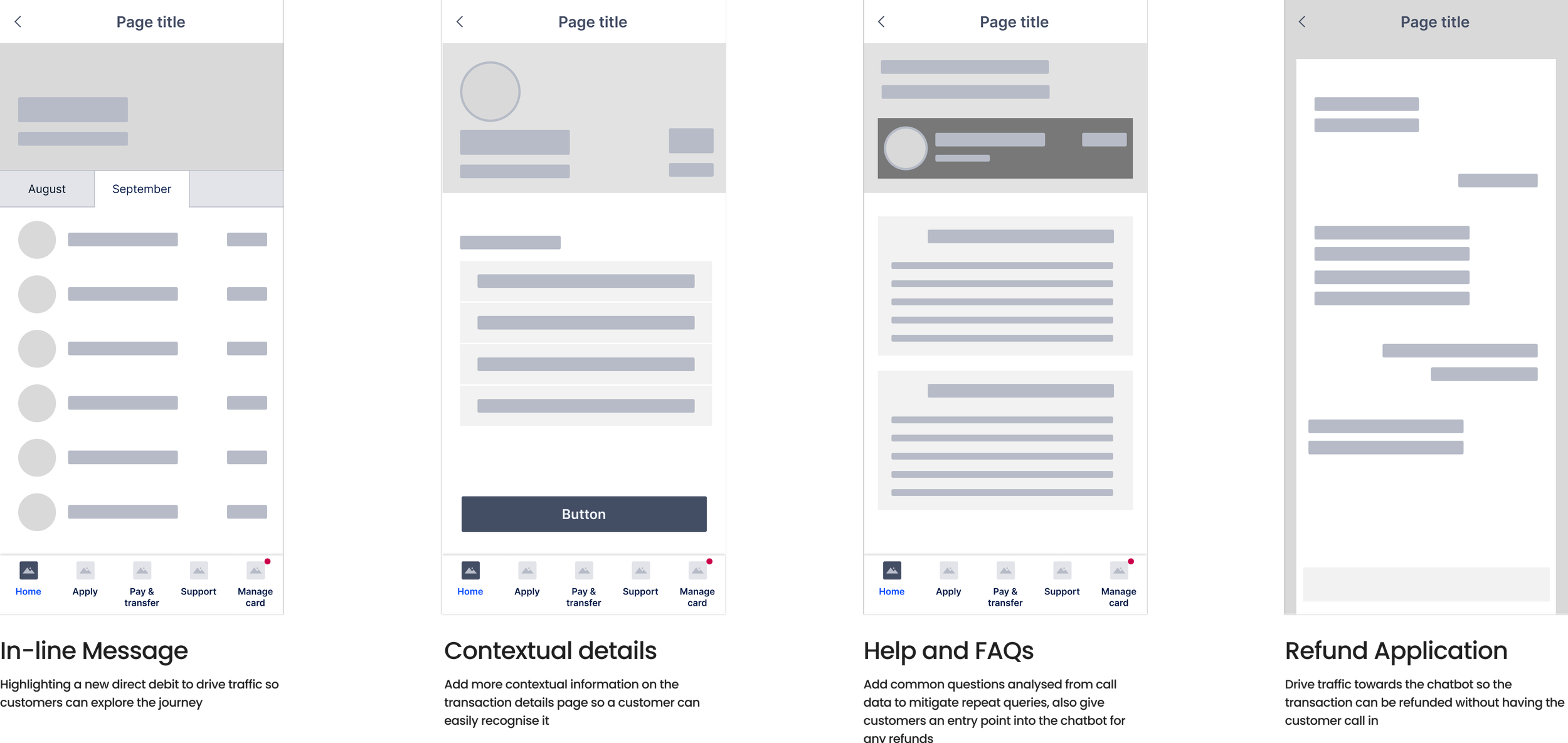

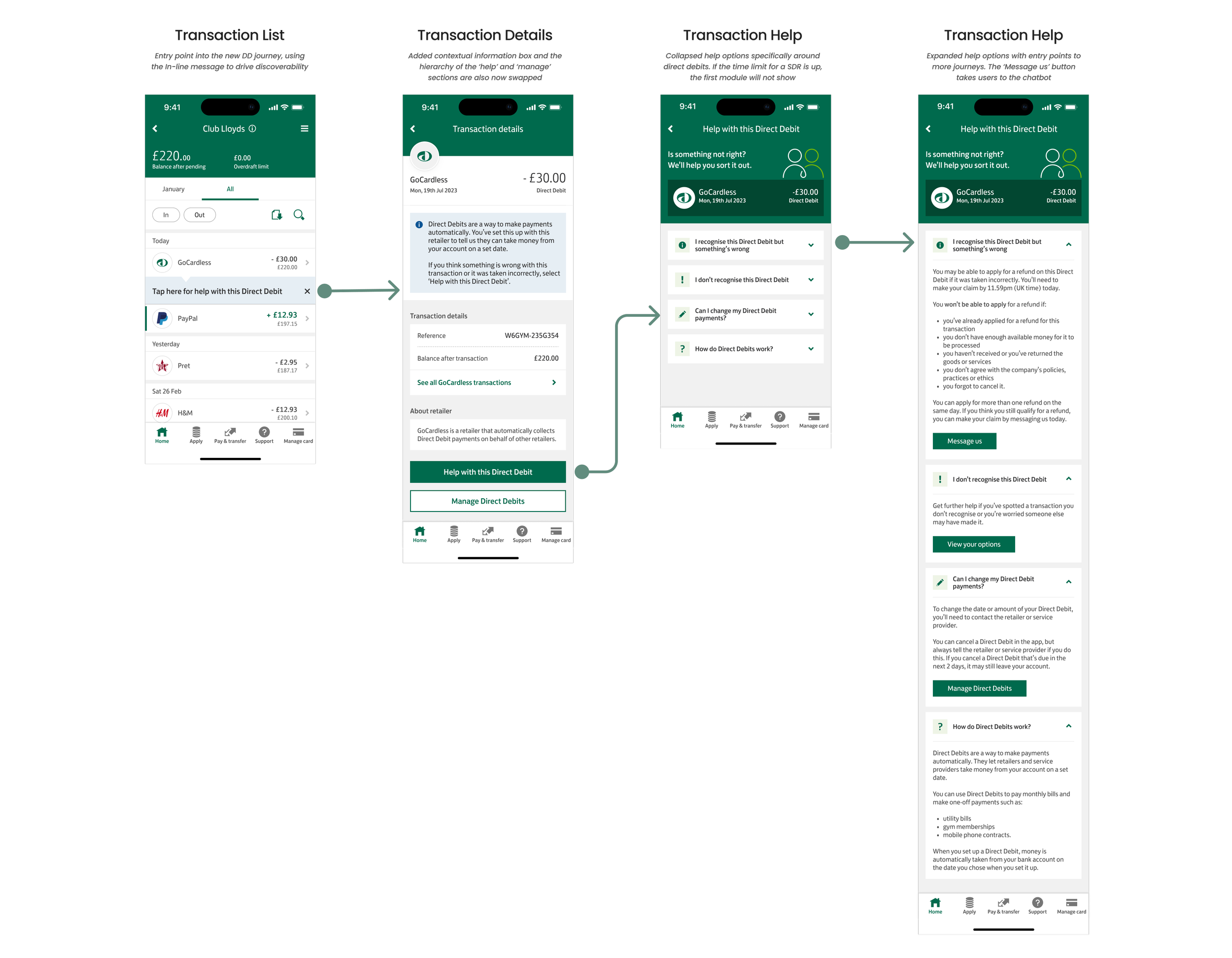

The entire experience is illustrated across the four pages below. Users initiate the journey through an in-line message on the transaction list, progressing through the details page until they arrive at the transaction help section. To maintain consistency with other help pages, I incorporated elements from our design system and implemented an accordion for each option.

Key Solution Elements

I workshopped out the experience at a basic level to show every page we would have designs for and began to hone in on the Help and FAQ page as this would be the main entry point to the chatbot.

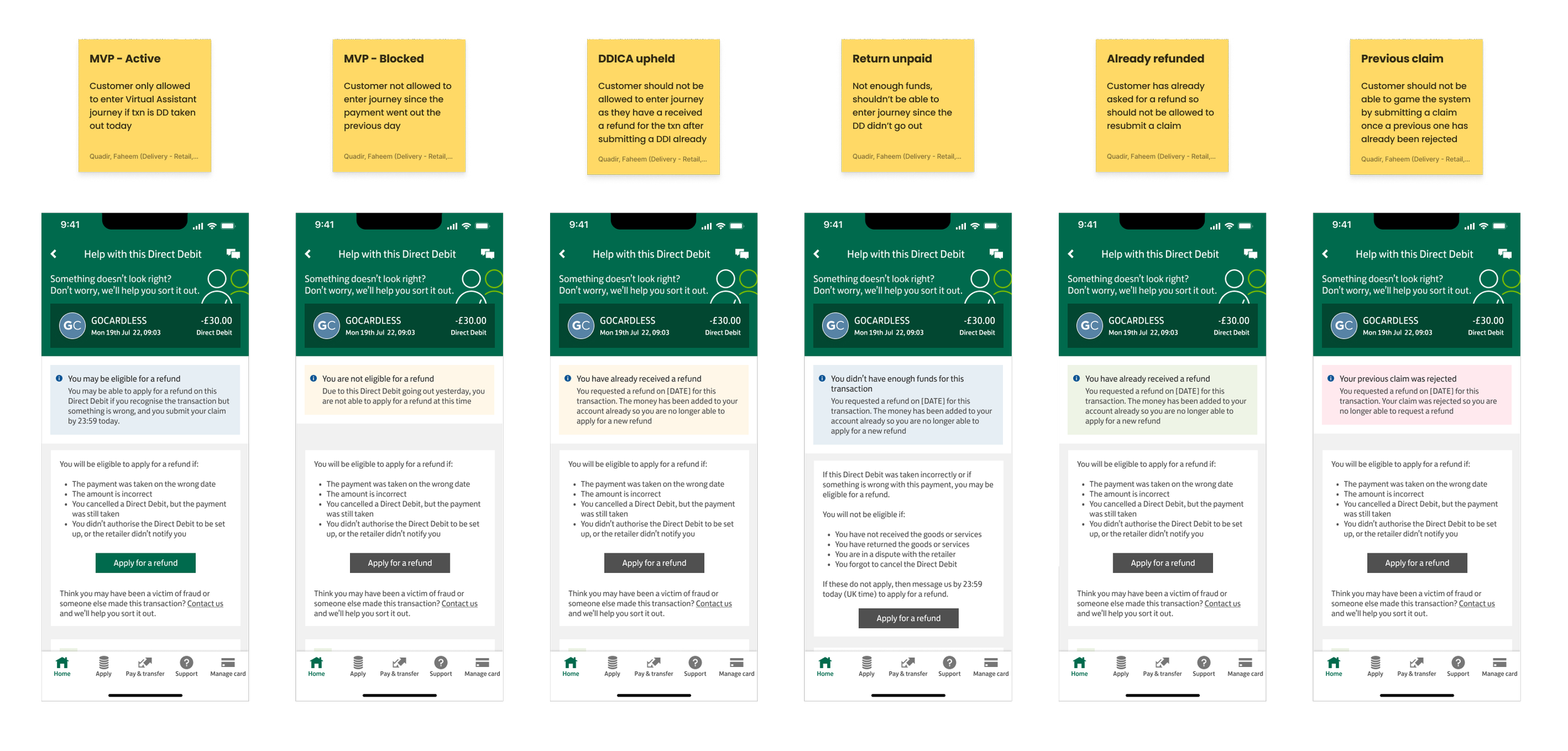

Ideation

Following stakeholder requirements, I ideated solutions for presenting different scenarios on a user's transaction details page. Leveraging components from our design system, I conducted comparative analysis with the Payments team, focusing on each scenario. For instance, in Scenario 2, where a customer received an ineligible for a refund due to the elapsed Same-Day Recall time limit, I proposed using a 'warning' colour for the message and blocking the 'Apply for a refund' entry point.

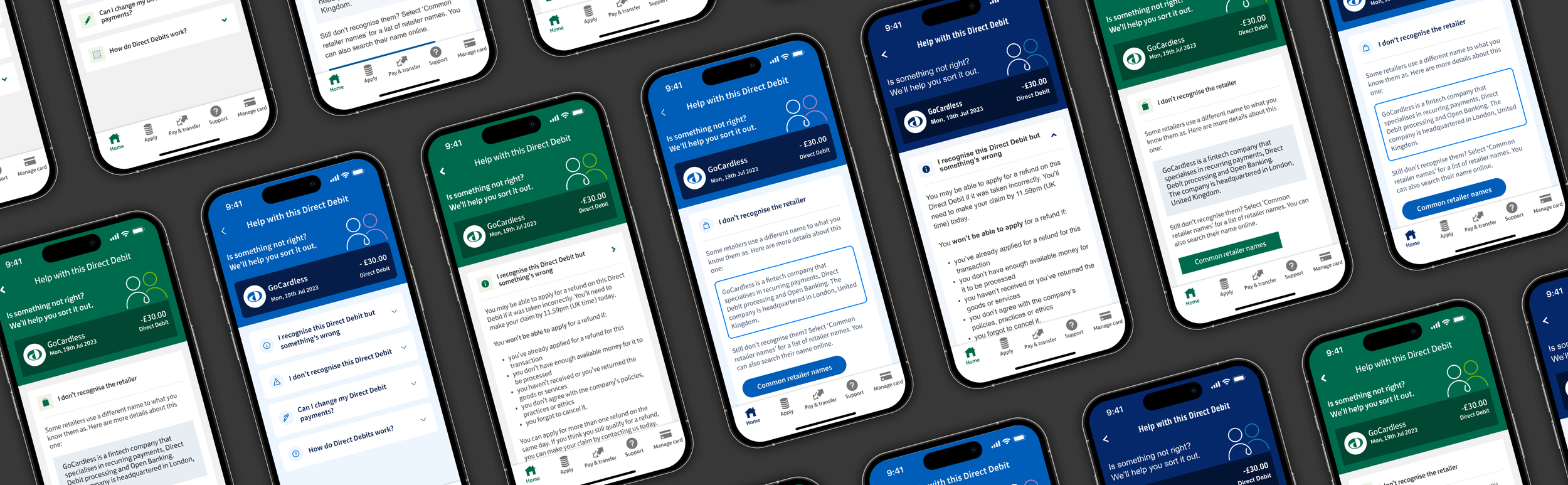

Final Demo

This video walkthrough shows the final build of the experience. It was an extremely fulfilling experience to have these designs be built and launched to our 20 million digitally active customers across all Lloyds brands.

Impact

After a phased release to customers, this experience went live in Q3 of 2023. Below is a snapshot of impact data from 4th-10th November 2023:

Of the 3 app entry points into the chatbot, 67% (~1900) were from our experience

97% (~840) of DDI claims were successfully refunded by ServiceNow

Our experience saved ~7600 minutes of call centre time which typically deal with these queries