Declined Transactions

Surfacing declines as a digital experience for the first time ever with Lloyds Banking Group

Business Goals

- • Drive down call-demand into customer service

- • Increase NPS scores

- • Deep-link into other streams like Push Notifications and Chatbot

Customer Goals

- • Find out why transactions are declined

- • Reassurance that account is safe

- • Pro-actively self-serve problems and reach resolutions quicker

Who we are

As a mixed Product and Design team, our purpose is to build deeper relationships with our customers by offering valuable, engaging, and human-like digital banking experiences.

Our main goal is to improve the way customers manage their money in order to Help Britain Prosper

Framing the problem

To understand the scale of the issue, it was important to look at different metrics which could indicate a digital opportunity to help our 20 million customers

In August 2023 we saw:

declined transactions

As a result, we receive:

calls annually

This equates to

Full-time employee hours

Decline Codes

When customers use their Debit card, the transaction undergoes checks to ensure its authenticity and compliance with policies. Our back-end system, BASE24, facilitates payments processing and aligns non-compliant transactions to an 3-digit decline code.

Card freeze and block

(030, 050, 150)

- I put a block on to prevent myself from gambling, but now I want to gamble

- There's a block or freeze on my account

- I was expecting this payment to be declined, has it been taken?

- I put a foreign transaction block on because I don't want unexpected charges

- I put a block on my card, and I can't find out how to unblock

Insufficient funds

(058)

- I want a quick and easy way of making faster payments to recuperate funds

- I don't have enough funds for my subscription, but the merchant keeps attempting the payment

- I've hit the limit of my arranged overdraft; can I increase it?

- I want to know what my upcoming payments are so I can transfer the right money across

- I tried to use TFL but didn't have enough funds and now I can't use the network

Limits reached

(045, 047, 046, 042, 044, 060)

- I want to understand how much money I can take out an ATM

- I want to manage the amount I spend on gambling merchants

- I want to manage my contactless limit

- Can I remove a limit on number of contactless transactions?

- Can I spend the same amount on contactless abroad as I can in the UK?

Incorrect details

(051, 151, 048, 094, 095, 062)

- I need to unblock my card after incorrect PIN entry

- I don't know why my card read failed

- I can't remember my card details

- I need to enter my PIN, but I can't remember it

- My card has expired or is damaged and I want to order a new one

- My subscription declined due to an expired card, but it then went through on my new card straight after

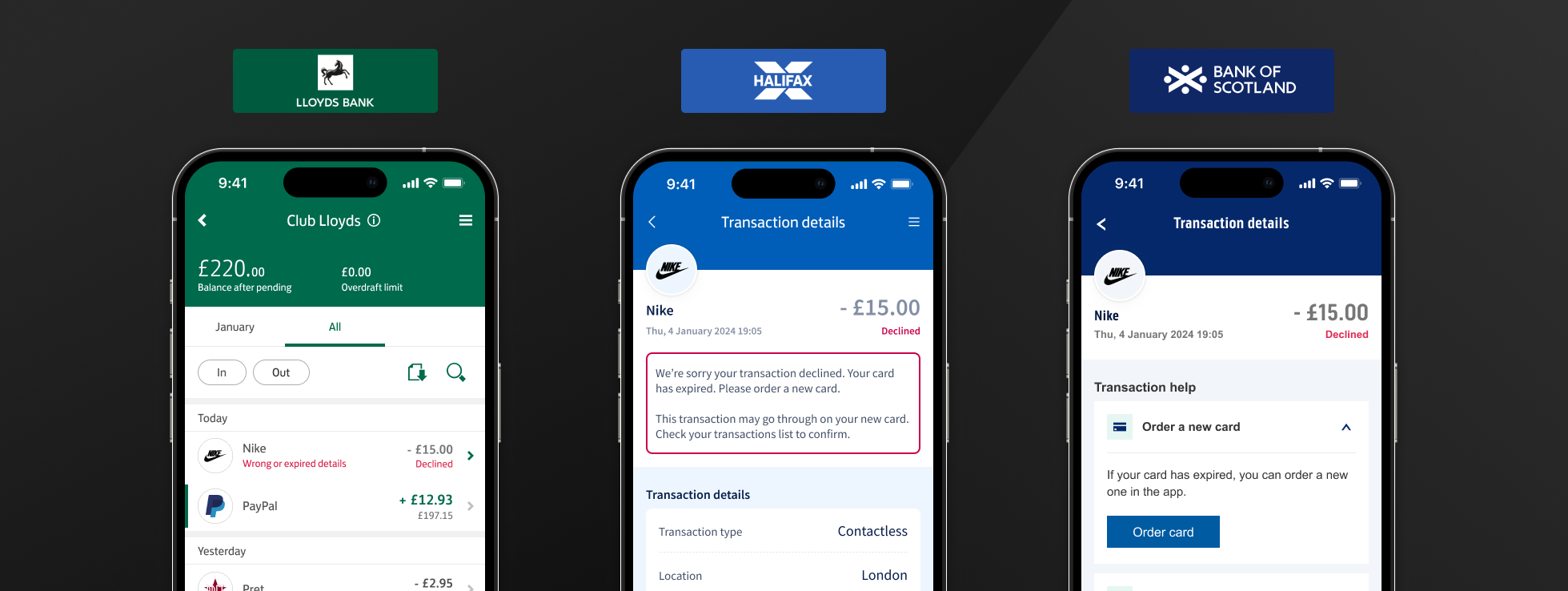

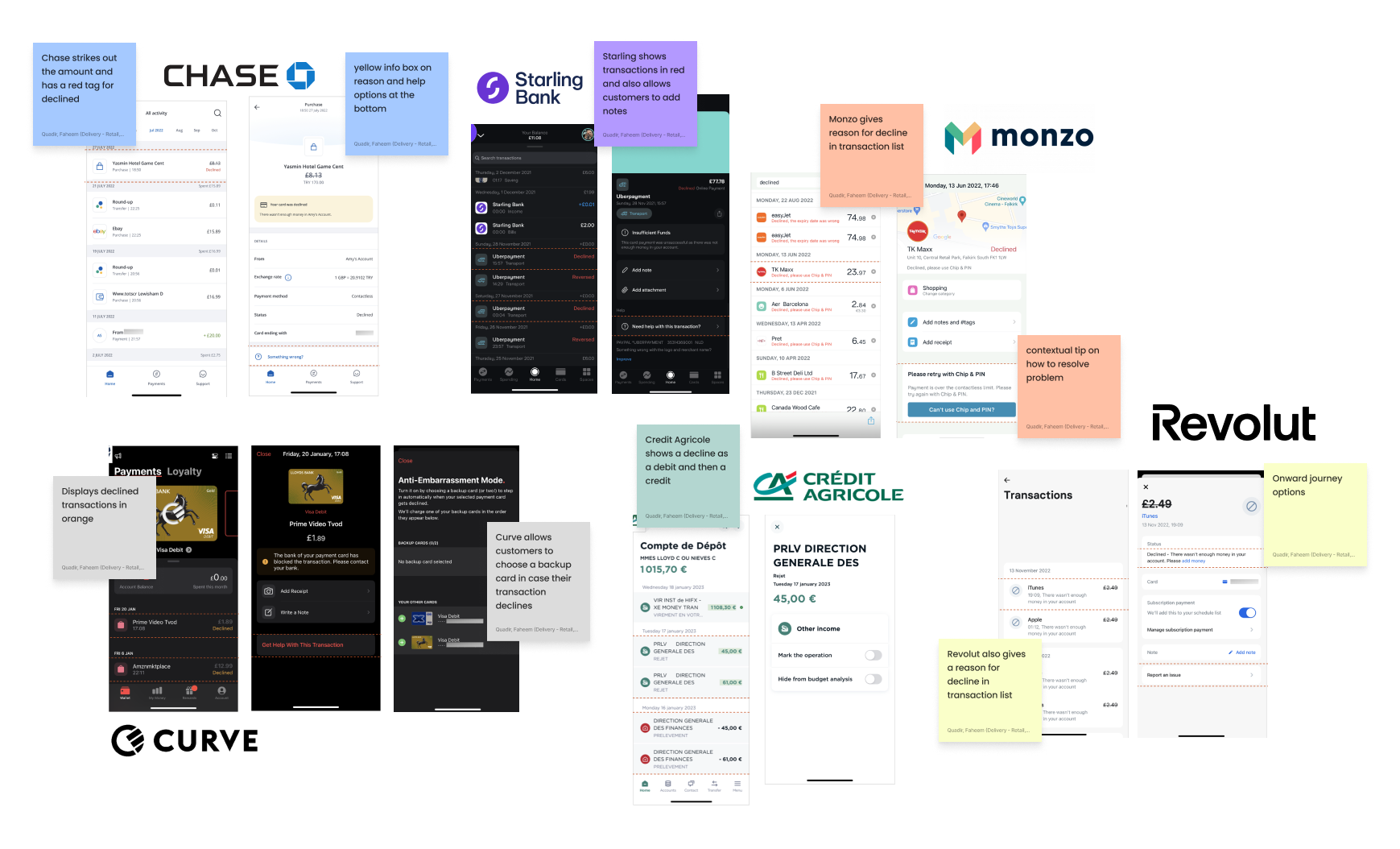

Competitor Analysis

Most Neo banks already surface declined transactions. Lloyds needs to bring itself up to speed with competitors and offer industry-leading features.

Colleague Feedback

In one of our fortnightly 'Design Crit' sessions, I presented early concepts to the wider group of designers to get their thoughts and suggestions

Feedback

- • Making sure the Swipe functionality is accessible

- • Take care in choosing a word such as Delete or Remove

- • Clarity around card freezes and how this design links with onward journeys

- • Is the details page visually distinctive?

- • How we can experiment with the hierarchy of different components

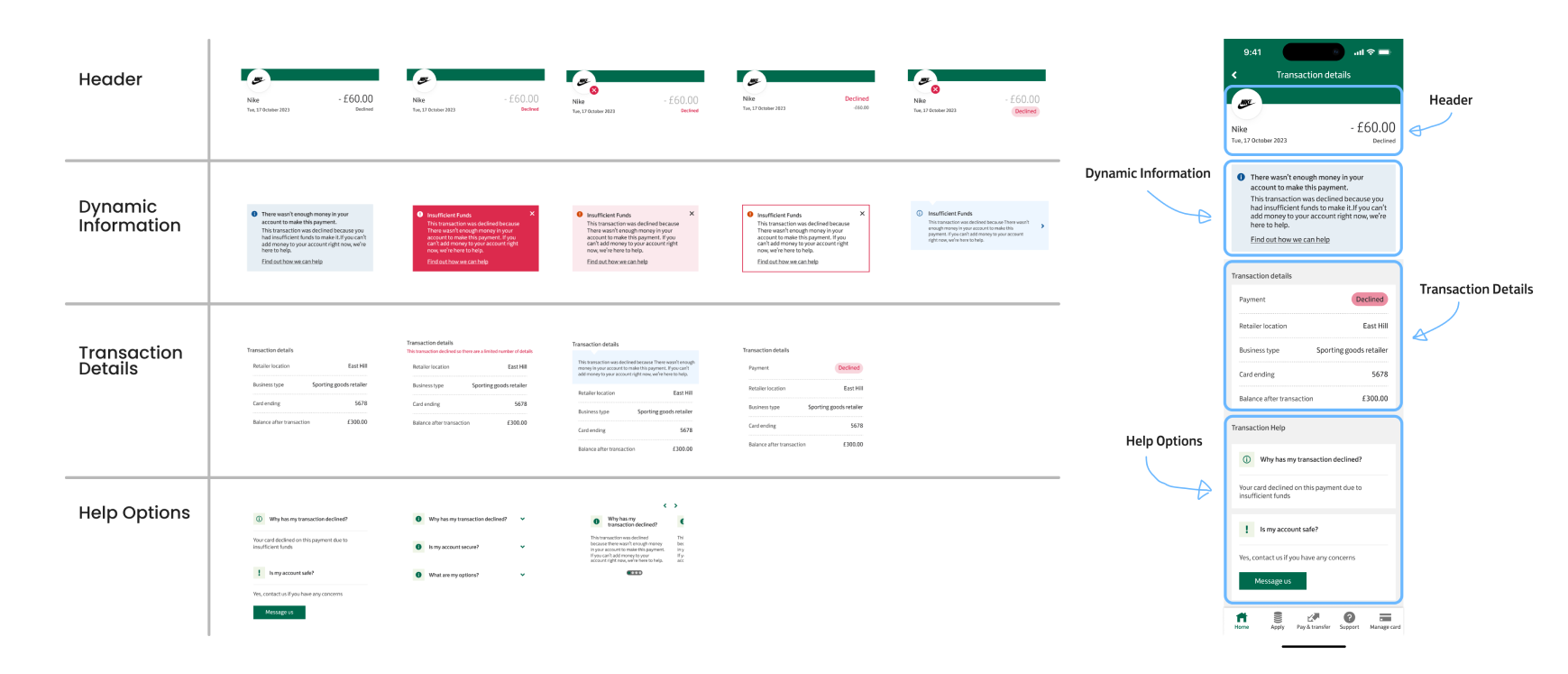

Iteration

Segmenting the transaction details page into parts allowed me to quickly iterate on visual styles to present back and take to further testing.

Header

Transaction overview and basic details

Dynamic Information

Contextual messages and alerts

Transaction Details

Detailed transaction information

Help Options

Support and resolution paths

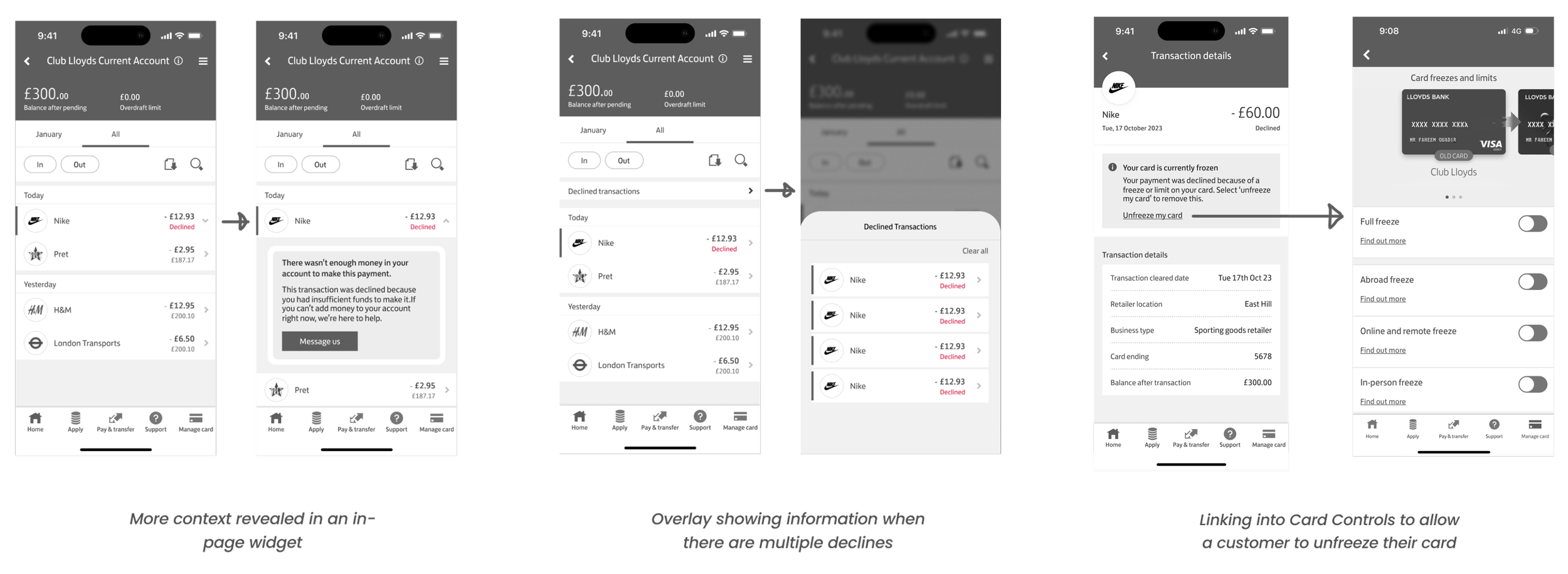

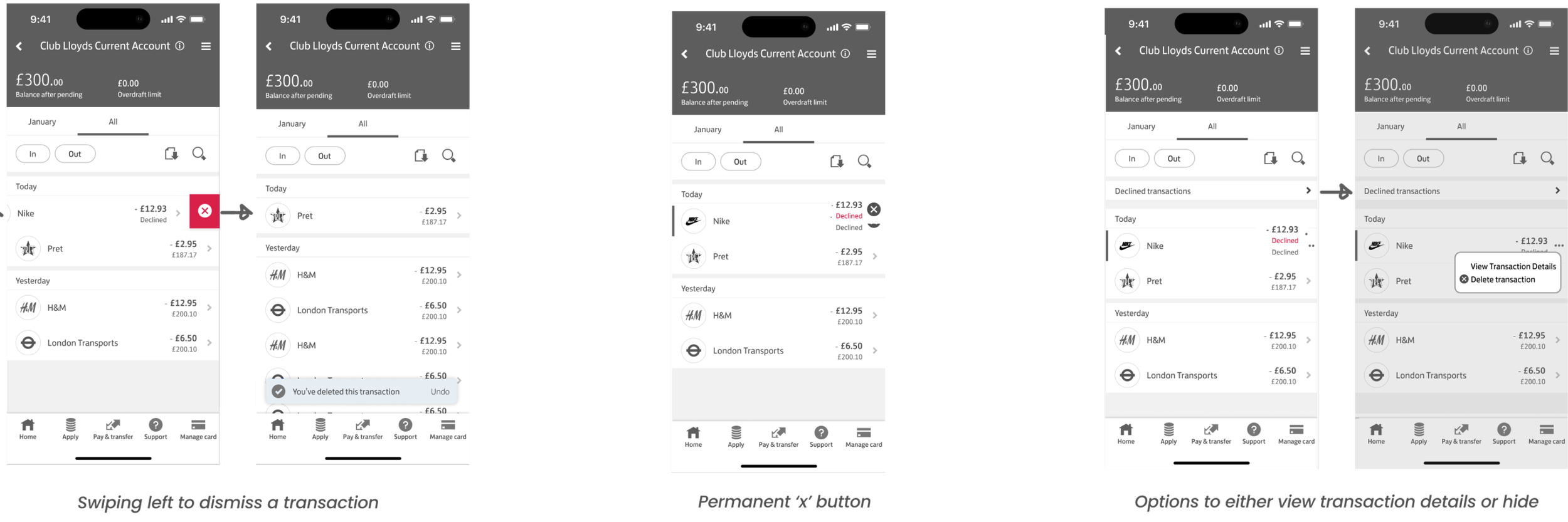

Initial Concepts

Using our library of components, I experimented with different ways we could surface information about declines on the transaction list and details page. One of the features stakeholders had wanted to include was the option to remove a transaction from the list. I mocked up a few different versions for how this could look to share with our team.

In-page Widget

More context revealed in an in-page widget

Multiple Declines

Overlay showing information when there are multiple declines

Card Controls

Linking into Card Controls to allow a customer to unfreeze their card

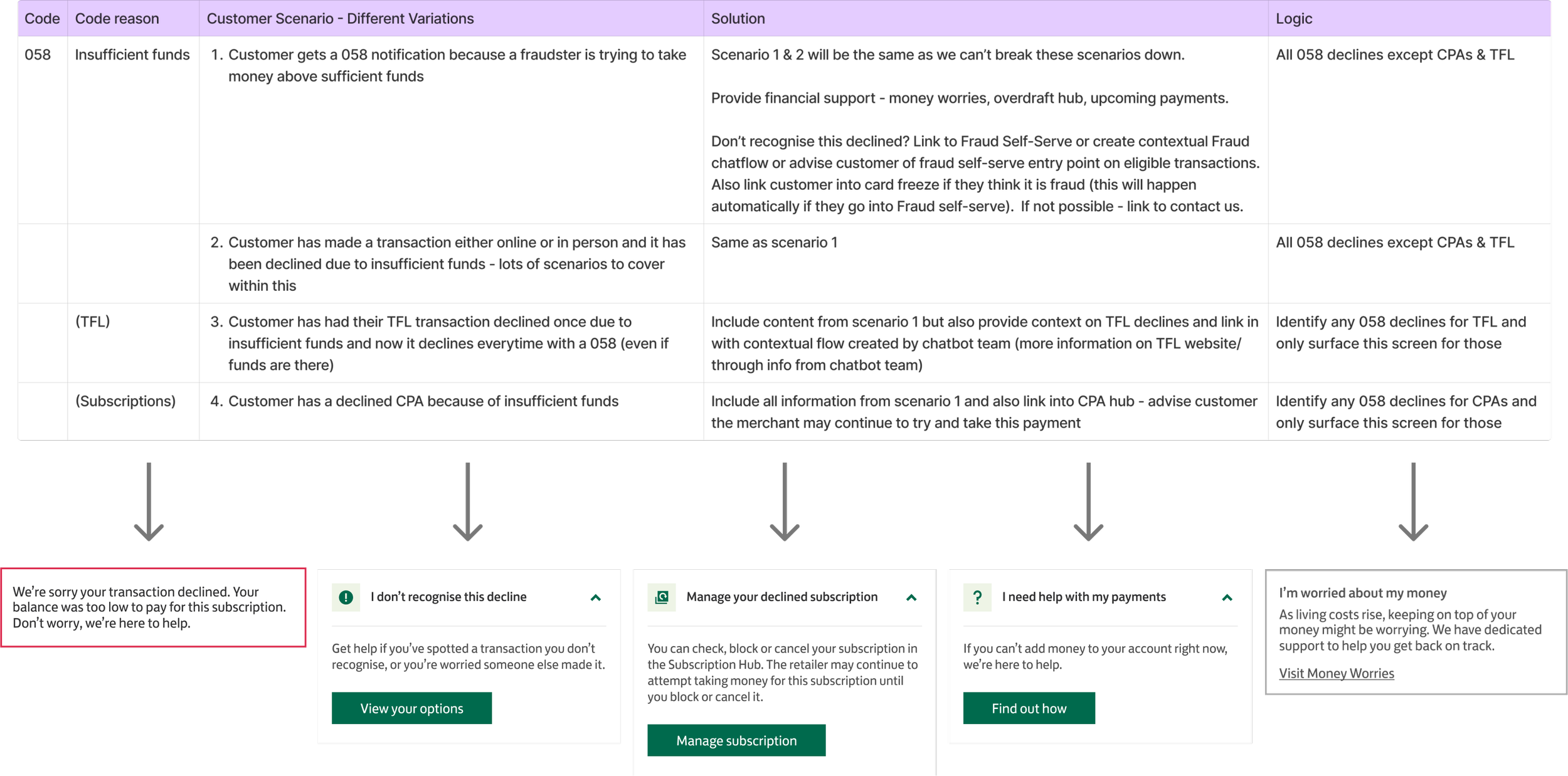

Collaboration with Product

Our Product Owner worked with stakeholders to suggest onward journeys and help options for each decline type. Alongside our UX Writer, I stress-tested our designs with each scenario.

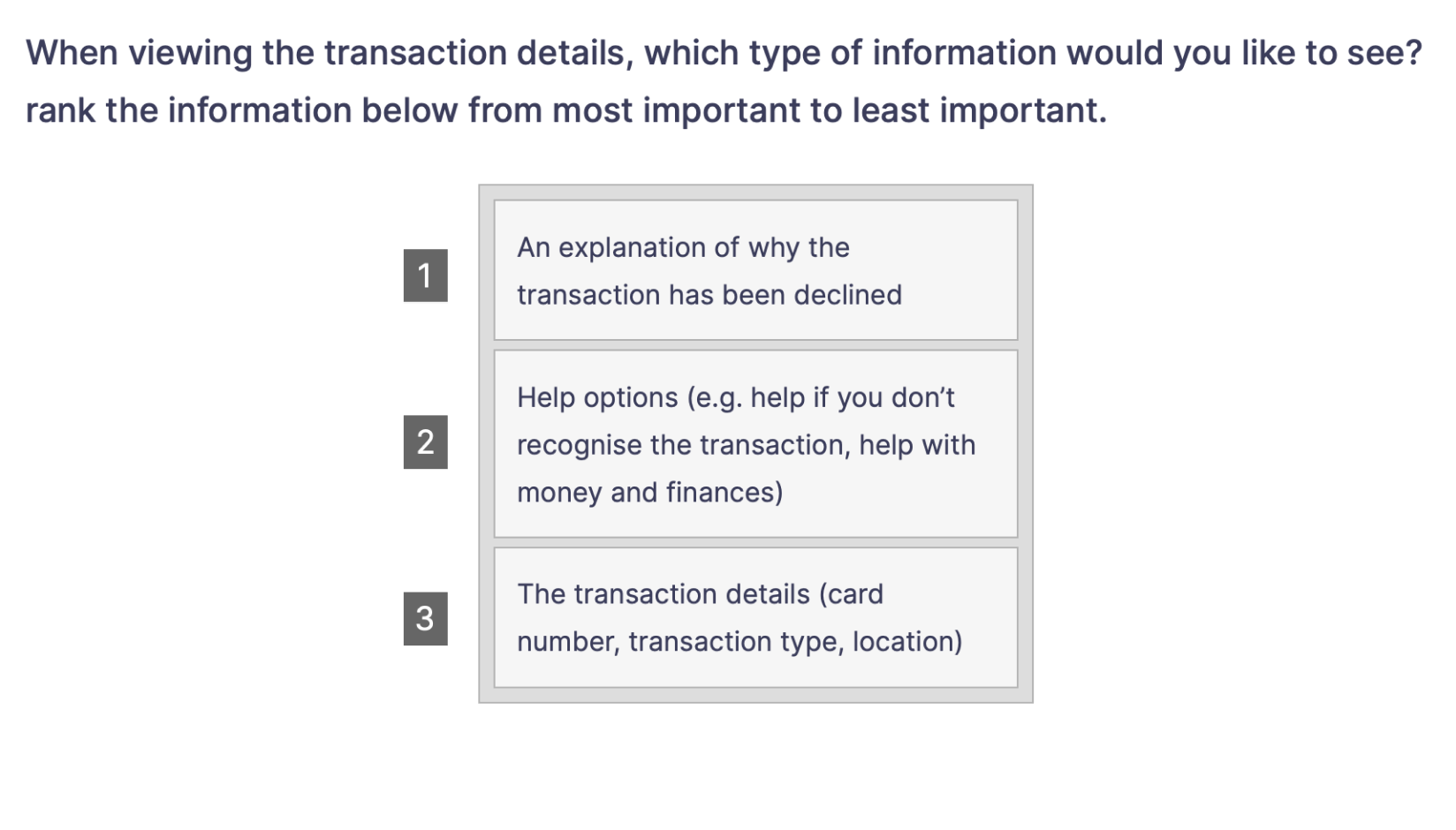

Research — Survey

With our in-house researcher, we sent a survey out to 95 customers and asked them their preferences on the visual aspects of certain components.

When viewing transaction details, which type of information would you like to see?

| Answer | Percent |

|---|---|

| An explanation of why the transaction has been declined | 34% |

| The transaction details (card number, etc) | 51% |

| Help options | 15% |

Answers included explanation of why the transaction has been declined, help options and transaction details.

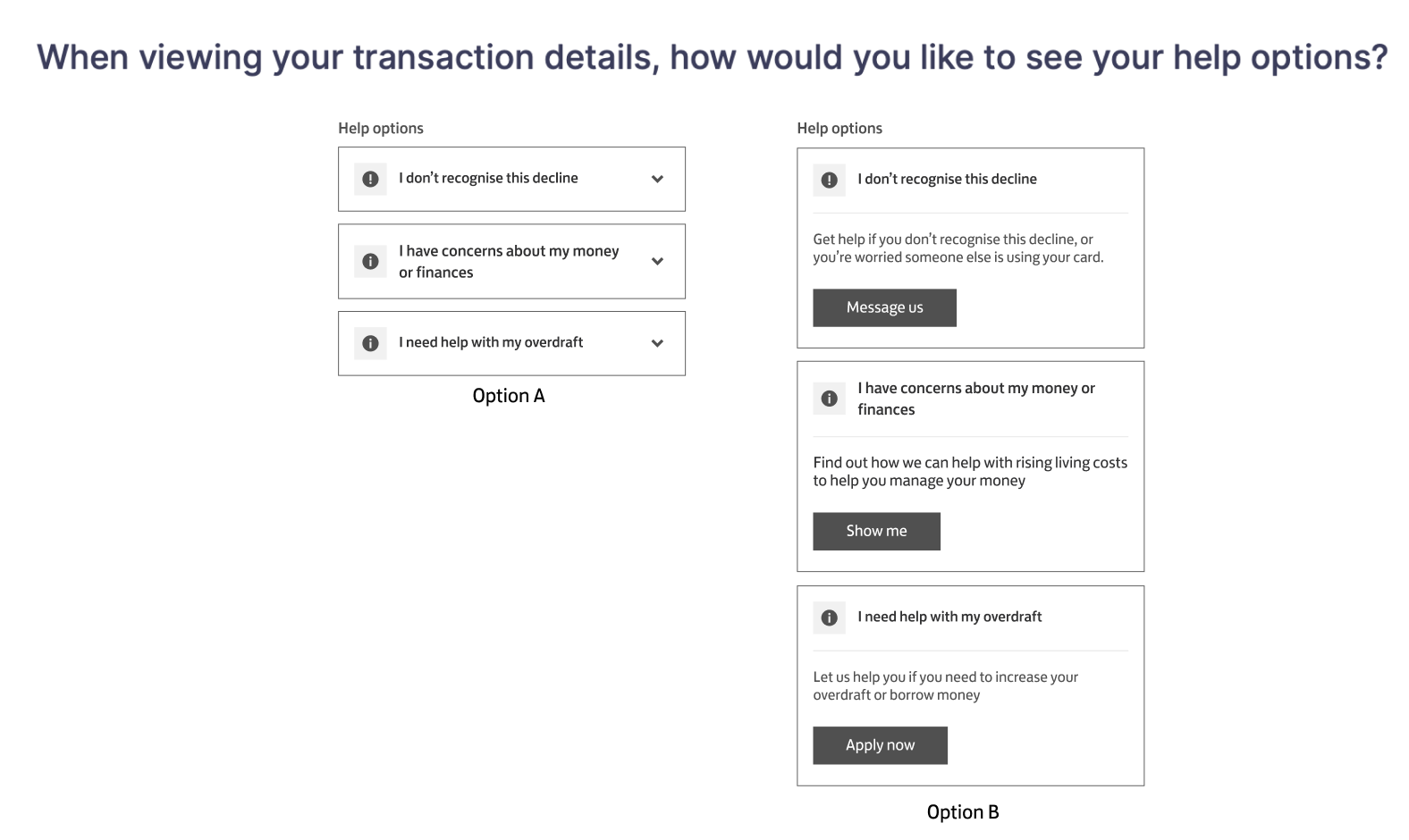

When viewing your transaction details, how would you like to see your help options?

| Answer | Percent |

|---|---|

| Accordion with drop-down arrows | 66% |

| Listed with a description of each option | 34% |

Options favoured accordions with drop-down arrows or a listed description of each option.

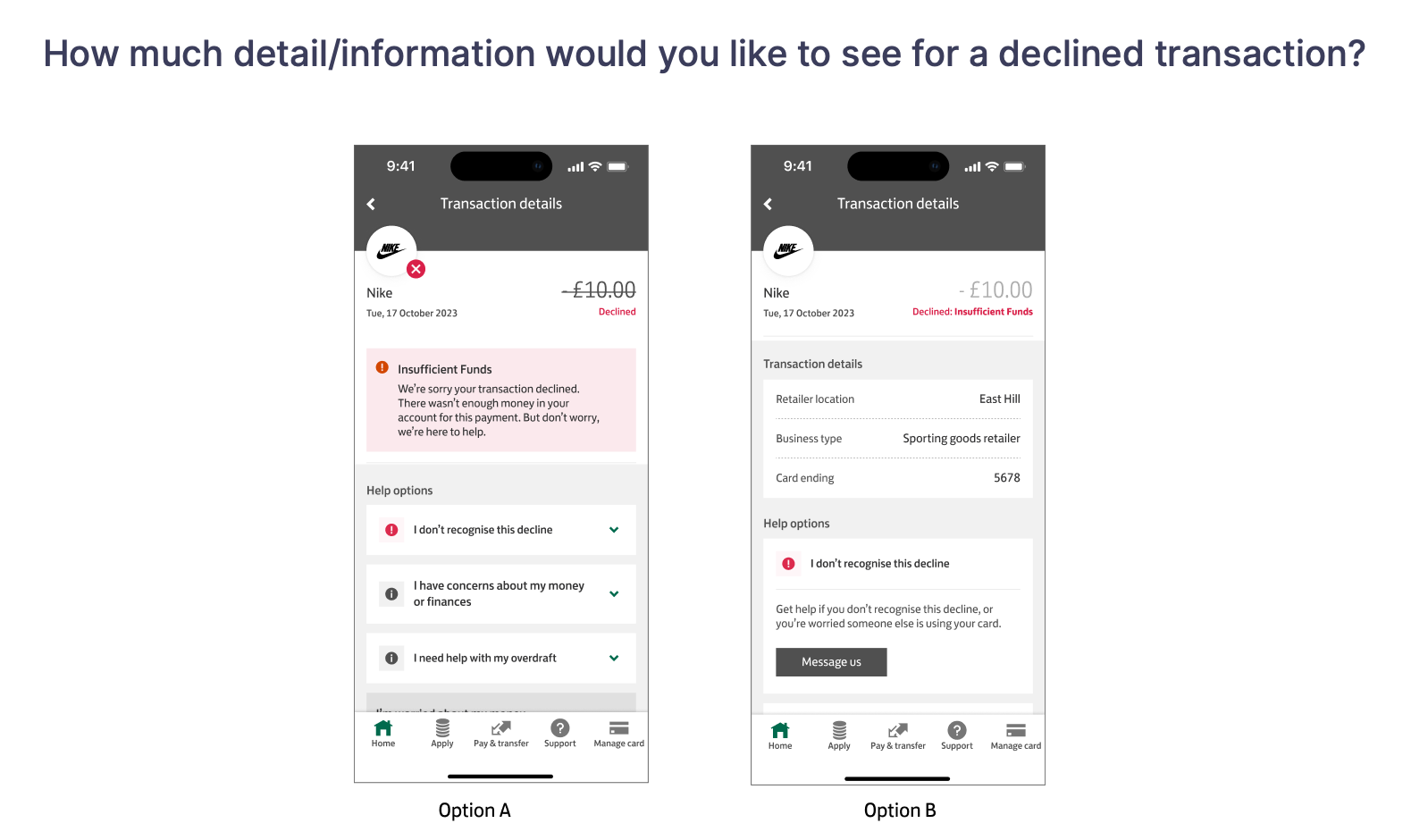

How much detail/information would you like to see for a declined transaction?

| Answer | Percent |

|---|---|

| A paragraph description | 54% |

| A shorter letter-style reason | 46% |

Respondents were split between a paragraph description and a shorter letter-style reason.

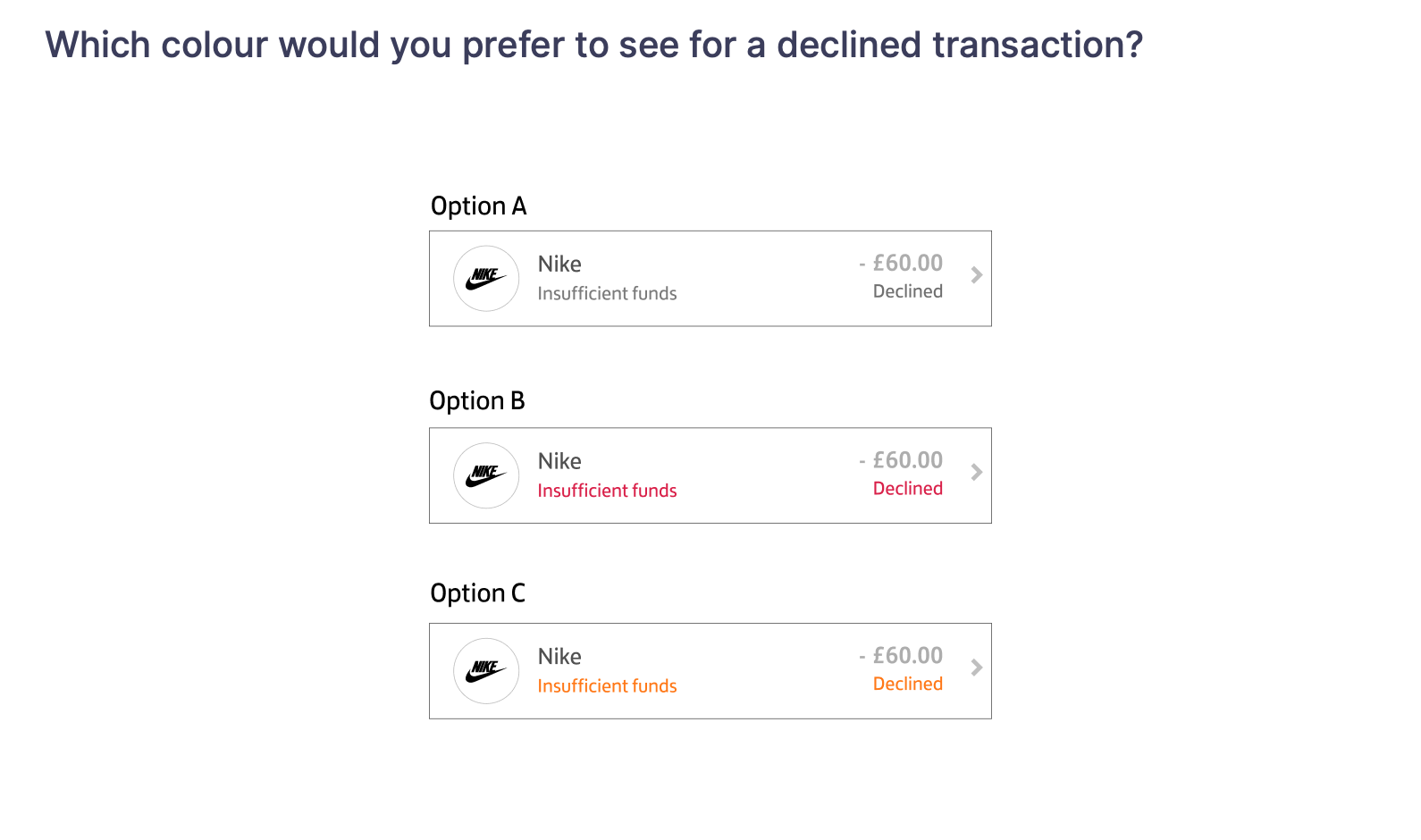

Which colour would you prefer to see for a declined transaction?

| Answer | Percent |

|---|---|

| Red | 76% |

| Orange | 13% |

| Grey | 11% |

Most respondents preferred the red option for clear visibility of declines.

Final Demo

Scenarios at Scale

Here's a snapshot of the different types of decline we surfaced

Impact after Delivery

Experience

Declined customers are more likely to opt into Push notifications

Customers like the new feature and it provides the information they require. They are also more likely to opt into push notifications which link directly to the declined transaction for a better end-to-end experience.

Behaviour

Organic increase in visits to self-serve help options

Most customers who self-serve do not require a call afterwards. The number of customers engaging with help options increased and this will lead to a drop in telephony demand.

Value

Reduction in calls to telephony customer service

Volume in calls reduced from 2.9% to 0.9% where customers had engaged with the declined notification. This directly reduces telephony costs to the business

Inclusion

Vulnerable customers are an increased sub-section who experience declines

We've noticed more vulnerable people who might are calling us on the phone. We need to learn more about how to best support them, because some people will always need a little extra help.